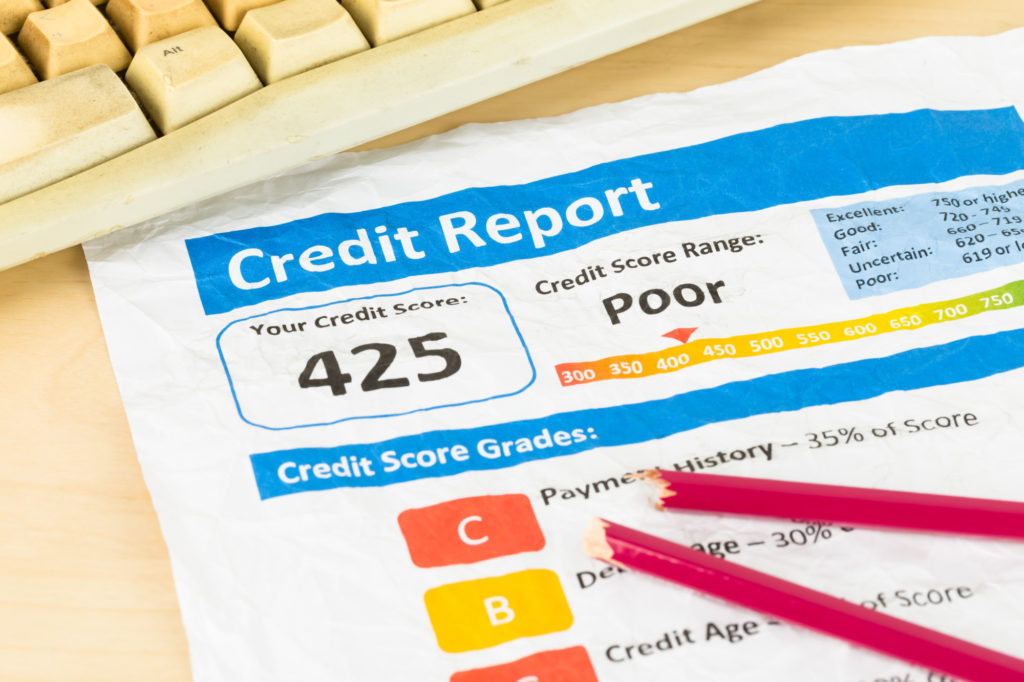

It’s common knowledge that credit scores are essential for most things we do. So, you may wonder, “how long does it take to improve your credit score?”

When your credit score is poor, it can hurt your ability to rent and own properties as well as take out loans.

It may feel like the end of the world if you have a bad credit score, but don’t worry, there are several steps you can take to start building back your credit.

First, Correct Any Errors on Your Credit Score

The length of time it takes to improve your credit will vary based on the severity of your score, but the first thing you should do is fix any errors.

This is a quick way to improve credit in a few months. Once you get a copy of your credit report, check for any identity errors or errors in your account.

Refute any errors you find to a credit bureau, and they can investigate it for you. The whole process takes around 30-90 days, but it’s worth it if it can quickly raise your score.

If You Have Thin Credit, Start Building a Thicker Credit History

Another common reason some people have bad credit is that their credit is thin. This means that you haven’t used your credit card enough to prove your creditworthiness.

This is a more manageable situation to be in because it only requires you to start making regular credit card purchases. Though, it should be noted that this requires consistency over time to impact your credit score. It won’t happen overnight.

Keep Your Credit Utilization Ratio Low

Your credit utilization ratio is the amount you owe versus your available credit. If you owe a large sum of money compared to your credit line, start paying it off.

If you have 80-90% of credit used, it’s going to pull down your credit score. This isn’t an easy solution because it requires a lot of payments, but it’s a quick solution.

If you aggressively pay off your credit, pulling your used credit down to 30%, you’ll see significant improvements in your score.

Finally, Be Sure Not to Miss Any Credit Payments

35% of your credit score is based on your payment history, including missed payments. Though you can’t do anything about the payments you’ve already missed, you should do everything you can to ensure you don’t miss another.

If you’re making your payments on time and following all the other steps, you will continue to see an improved credit score.

If you need more information, these are the best credit services available.

How Long Does it Take to Improve Your Credit Score? Now You Know

So, how long does it take to improve your credit score? The short answer is that it depends on how bad your credit score is. The most important thing is to follow these steps consistently and spend wisely.

Over time, you should start seeing a significant increase in your score.

If you found this article helpful, be sure to check out the rest of our blog. We cover an array of topics, including other great articles on finance that you’re sure to love!

![Fan Expo Chicago [Convention], Donald E. Stephens Convention Center, 16 Aug What You Need to Know](https://www.thefreemanonline.org/wp-content/uploads/2024/09/Fan-Expo-Chicago-Convention-Donald-E.-Stephens-Convention-Center-16-Aug-What-You-Need-to-Know-74x55.jpg)

![Error [err_http_headers_sent] Cannot Set Headers After They Are Sent to the Client How to Fix](https://www.thefreemanonline.org/wp-content/uploads/2024/09/Error-err_http_headers_sent-Cannot-Set-Headers-After-They-Are-Sent-to-the-Client-How-to-Fix--74x55.jpg)

Add Comment